nj bait tax example

NJ Business Alternative Income Tax BAIT By Michael Brown CPA. The tax rates for NJ BAIT range from 5675 to.

New York State Pass Through Entity Tax Ptet What All Business Owners Need To Know Youtube

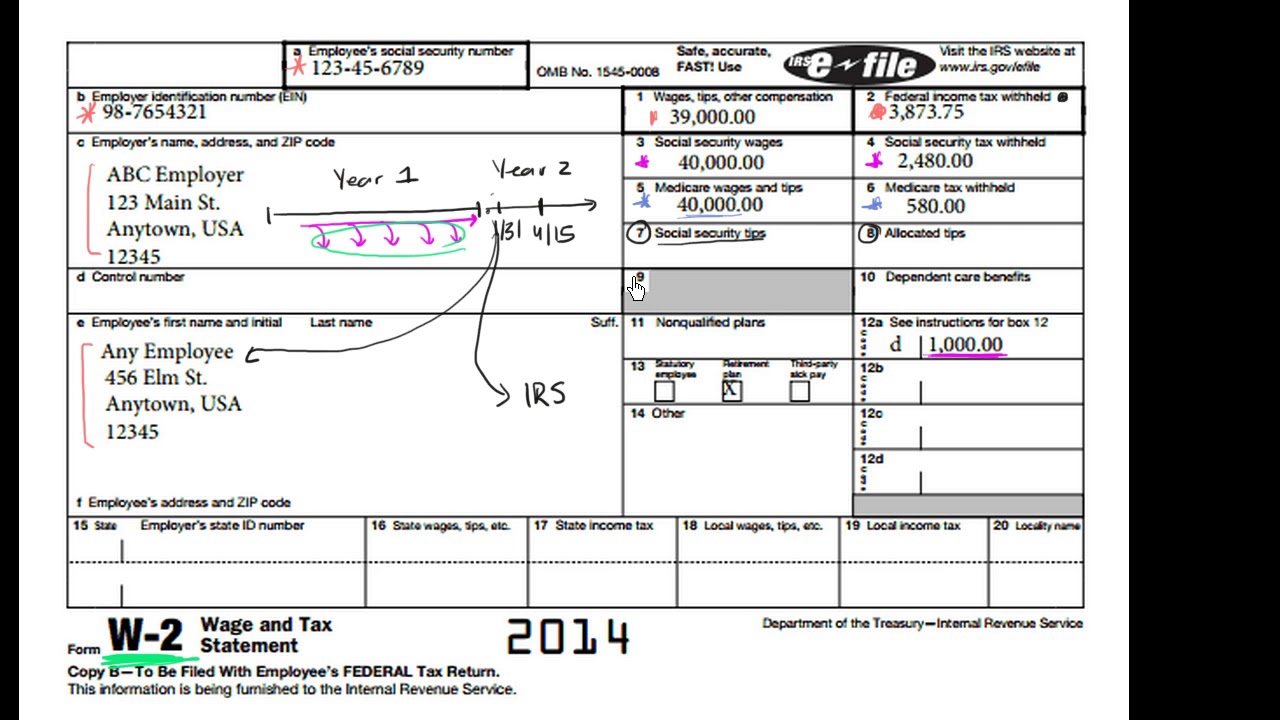

Were going to take a deduction for the New Jersey BAIT paid in 1581750 resulting in 25918250 a federal income and allocated the three ways 8639417.

. The New Jersey Business Alternative Income Tax also referred to as BAIT or NJ BAIT helps business owners mitigate the negative impact of the federal state and local. September 3 2021. Finally we add the 63087 base to the 10900 tax to obtain the elective entity tax.

The owners then receive a proportionate credit on their New Jersey gross income tax liability. Partners with a calendar year end of 123122 will claim credit for their share of the 2021 BAIT on their 2022 New Jersey tax returns. For S-corporations BAIT is calculated on NJ source income from the K-1.

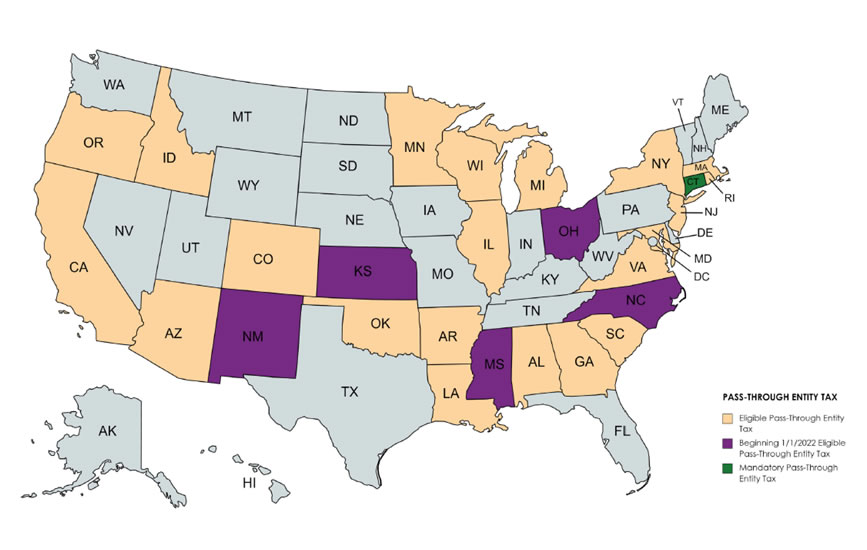

The New Jersey Business Alternative Income Tax or NJ BAIT allows pass-through businesses to pay income taxes at the entity level instead of the personal. There is no limit on the deduction of state taxes. On January 13 2019 the New Jersey governor signed S.

3246 into law referred to as the Pass-Through. 1418750 plus 652 for distributive proceeds. Each are 50 members.

Pass-Through Business Alternative Income Tax PTEBAIT For New Jersey tax purposes income and losses of a pass-through entity are passed through to its members. For the 2020 tax year the four tiers of income tax rates are as follows. Taxpayers who earn income from pass-through businesses and pay the BAIT can obtain a refundable gross income tax credit.

The highest tax bracket now kicks in at 1000000 to be more in line with individual tax rates. When Governor Murphy signed the Pass-Through Business Alternative Income Tax BAIT into law. Each member can use the BAIT.

63087 10900 1100000 1000000 100000 x 109 10900 73987. Amount over 250000 but not over 1 million 1418750 plus 652 of excess over 250000 652. In January 2020 New Jersey enacted the Pass-Through Business Alternative Income Tax BAIT.

The entity must have at least one member who is liable for tax on their share of distributive proceeds pursuant to the New Jersey Gross Income Tax Act NJSA54A1-1 et seq in a. 5675 for distributive proceeds under 250000. By Jeanne-Marie Waldman and William Gentilesco.

Pass-Through Business Alternative Income Tax PTEBAIT For New Jersey tax purposes income and losses of a pass-through entity are passed through to its members. Individuals estates and trusts receive a credit against their gross income tax equal to the members tax on the share of distributive proceeds paid by the pass-through entity. Tax brackets were expanded to include the 109 bracket for distributable proceeds attributable to the PTE more than 1 million which will be more generous and align BAIT with.

Summary of New Jersey Pass Through Business Alternative Income Tax Act. 3246 or bill establishing the business alternative income tax BAIT an elective New Jersey. The BAIT is intended to give NJ individual income taxpayers a work-around of the.

On January 13 2020 Governor Phil Murphy signed into law Senate Bill 3246 S. Amount over 1 million but not over 5 million 6308750. The distributive proceeds sourced to New Jersey are allocated 450000 to Member A and 450000 to Member B.

New Jersey What Is My State Taxpayer Id And Pin Taxjar Support

Partnerships And S Corporations Exempted From Limits On State And Local Tax Deduction

The Pass Through Entity Tax A Salt Limitation Workaround Marcum Llp Accountants And Advisors

New Jersey What Is My State Taxpayer Id And Pin Taxjar Support

Nj Business Alternative Income Tax Bait By Michael Brown Cpa Prager Metis

Explainer Decoding Nj S Budget Babble A Dictionary Of Useful Terms Nj Spotlight News

New Jersey Pass Through Business Alternative Income Tax Bait Updates Marcum Llp Accountants And Advisors

Irs Sweetens Tax Workaround For Nj Pass Through Owners Grassi Advisors Accountants

New Jersey Pass Through Business Alternative Income Tax Act Bait L H Frishkoff Company

2018 New Jersey Payroll Tax Rates Abacus Payroll

Nj Governor Signs New Laws That May Impact Your Business Or Non Profit Alloy Silverstein

New Jersey Business Alternative Income Tax Nj Bait Tax Knowledge Hub

Nj Bait And New Salt Guidance What You Need To Know Smolin

Nj Bait Year End Tax Planning Considerations For Pass Through Entities Wilkinguttenplan

Nj Budget 2022 Read Gov Phil Murphy S Address Nj Spotlight News

Treatment Of Payments For Entity Level Tax On Pass Through Entities Marcum Llp Accountants And Advisors

Nj Business Alternative Income Tax Bait By Michael Brown Cpa Prager Metis

Pa Dor Response To Nj Salt Work Around Pass Through Entity Tax